News

5 TIPS TO HELP PROTECT YOUR BUSINESS FROM CREDIT CARD FRAUD

It is always

important to safeguard your business. This includes taking steps to protect

against credit card fraud. Check out these 5 tips.

Tip #1: Make

sure your business is EMV Compliant

Chip technology is a

superior alternative to the magstripe predecessor, making it harder for

criminals to clone credit cards and preventing thieves from using a skimmer to

copy card data during a swiped transaction. While this safeguards your customers,

if your business is not EMV compliant, you could be at risk. If you process a fraudulent

charge in a non-EMV-compliant terminal, you accept the liability which could

equate to thousands – or even tens of thousands of dollars.

Tip #2:

Establish Card Present Transaction Standards

As a business, purchases

for goods and services are primarily made in person. Although face-to-face

transactions make it easier to identify potential red flags when it comes to

fraud, it is still best practice to maintain certain standards. Always inspect

the credit card to ensure it has not been tampered with. Double check the

expiration date and ensure the card carries a signature. If you are uncertain,

ask for photo identification. Maintain the card throughout the transaction and

verify the account number on the terminal matches the account number on the

card.

Tip #3:

Create Protocols for Card-Not-Present (CNP) Transactions

Especially in the

landscape of the pandemic, there are times when you may not be able to accept

credit cards in person. When the card is not present, always be sure to capture

the CVV2 code, billing zip code and street address associated with the card.

(Capturing this information also reduces your transaction fees!) Take note

of orders that are larger than normal for your business, orders that include

several of the same items or a request for a rush or overnight shipment to help

identify potential fraud and protect your business.

Tip #4: Keep

All Records Organized and Current

It may sound redundant

but keeping detailed records of each transaction in an organized manner will

help you in the long run. Should you receive a chargeback, you will easily be

able to pull that transaction’s information in order to dispute it. This means

maintaining receipts, sales orders, invoices, purchase orders, shipping

information, confirmation emails and other additional transaction records.

Tip #5: Stay

in Regular Contact with Your Merchant Services Provider

Staying in regular

contact with your merchant services provider is always a great way to help

prevent credit card fraud. They are there for you through customer service and

technical support and can always lend a hand when it comes to explaining EMV

compliance, how to dispute a chargeback and more.

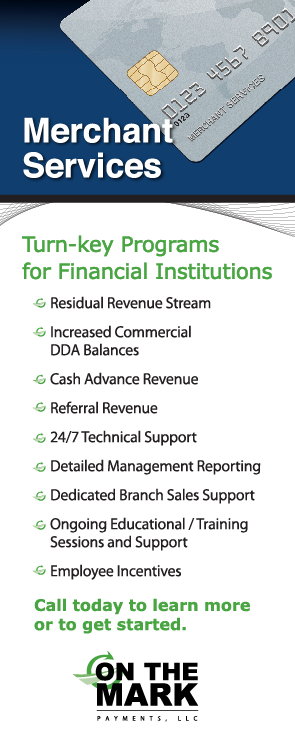

At OTM

Payments, we are more than a team of industry veterans. We are family-owned and

operated and take our role as your partner very seriously. Our customized and

technology-driven processing solutions are distinctive, and we make sure they

fit every unique business environment and their specific needs.

Ready to start

accepting credit cards with ZERO fees? Contact us for more information on how

we can help sales@onthemarkpayments.com or give us a call at 732-270-7702.

Deprecated: Function utf8_decode() is deprecated in /home/otmpportal/public_html/includes/banner1.php on line 32